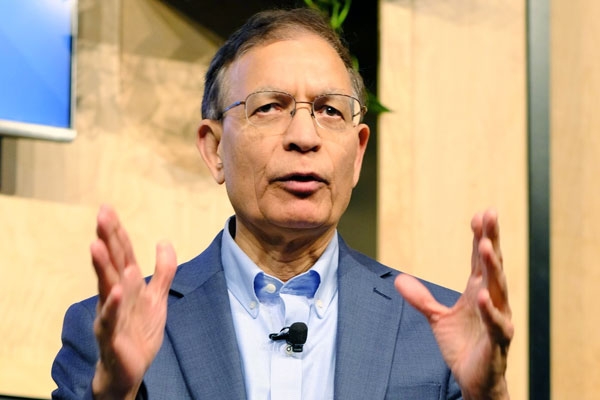

(Image source from: Facebook.com/Zscaler)

Jay Chaudhry, the 65-year-old founder and CEO of the cloud security giant Zscaler, is estimated to have a net worth of more than $11 billion. Surprisingly, he claims to have never truly cared about accumulating wealth. This mindset, ironically, is what helped him become a billionaire. Chaudhry, who grew up in a small village in rural India, explains that he never had money during his early years, so the idea of amassing wealth was never a priority. This perspective, he believes, was instrumental in his decision to become an entrepreneur. In 1997, Chaudhry and his wife Jyoti quit their jobs and invested their life savings, approximately $500,000, into a cybersecurity startup called SecureIT. They recognized an opportunity to establish a foothold in the burgeoning internet industry. Undeterred by the possibility of losing their savings, the couple's "pretty simple" lifestyle, which involved minimal spending, gave them the confidence to take the risk. They were also convinced that they could find new jobs if their startup venture failed, a mindset Chaudhry attributes to his family upbringing, which "never changed."

Some individuals who acquire substantial wealth often feel compelled to indulge in extravagant purchases, such as multiple homes, boats, and planes. However, the 65-year-old entrepreneur finds this type of behavior to be a burdensome distraction. The couple worked collaboratively to establish their companies, with Mr. Chaudhry serving as the chief executive officer while his wife oversaw the financial, operational, and human resources aspects in the initial stages. Less than two years after launching SecureIT, they sold the company for approximately $70 million in stock. Using a portion of those proceeds, the couple founded several additional businesses, eventually investing around $50 million to establish Zscaler in 2007. The company went public in 2018 and is currently valued at approximately $29 billion. The billionaire attributes his prudent approach to wealth management as a key factor in his ability to make strategic, long-term business decisions. He has observed that individuals who raise significant capital often invest in lavish office spaces and unnecessary luxuries, whereas using one's own funds instills a more responsible and thoughtful approach to business operations. "Mr. Chaudhry proposed that we take a chance and commit to this project together," he said conclusively.